The Covid-19 pandemic is changing the way the healthcare industry functions, especially its standard operating procedures and the services it offers. Most notably, Covid-19 is reshaping healthcare through technology (healthtech), which is increasingly becoming an integral part of the care delivery model.

The outbreak has not only presented a new opportunity for innovators to create faster, smarter, and more accurate predictive healthcare tools for diagnosis and treatment, but has also amplified the necessity for healthcare organisations to scale and adjust to the new reality.

Recent developments in the arenas of telehealth, artificial intelligence (AI), machine learning (ML), virtual consultations, robotics and big data/data tracking are helping tackle the Covid-19 outbreak and flatten the infection curve.

Not just doctors, clinicians and researchers, but even governments across the globe are increasingly turning to new-age technologies for R&D, to deliver services and cater to a rapidly growing pool of patients.

Over the years, the concept of digital health has evolved from merely eliciting curiosity to being explored as a research tool, and finally evolving into a widely-adopted, mainstream clinical tool. Smart technologies have made it possible to overcome the shortcomings of traditional healthcare models through groundbreaking curative discoveries, and by enhancing the delivery of services.

Accordingly, digital opportunities within remote consultations and diagnostics, and innovations in the fields of telemedicine, drugs and vaccine development are increasingly taking centre stage. Such developments have prompted a strong surge of interest in the healthtech sector.

The pandemic has further aggravated this interest, with the first six months of 2020 raking in a record $6.3bn in new investments. Moreover, several tech giants including the likes of Amazon, Apple, Google and Microsoft have pivoted to focus on technologies and services (for both enterprise and community) to battle Covid-19. Simultaneously, many governments are strongly advocating the use of digital technologies to confront Covid-19 and address a wide range of pandemic-related issues. Such strong sentiment, although triggered by the pandemic, could very well be indicative of a trend that is here to stay.

It would not be wrong to say at this point that many of the developments in the various tech sectors which were taking place over the last decade didn’t get the kind of response that 90 days of this year led them to receive. The growth in some of these sectors, such as healthtech, are unimaginable in normal circumstances – for example remote healthcare visits are estimated to have grown by more than 4,000 per cent.

In such a scenario, several global healthcare companies are attracting investor interest by fostering technology as a core part of their business strategy. Similarly, new and innovative digital healthcare startups are raising record amounts in fresh funding to expand their solutions and offerings. The crisis has opened up many growth avenues for healthtech ventures, which are attracting a significant amount of investor interest.

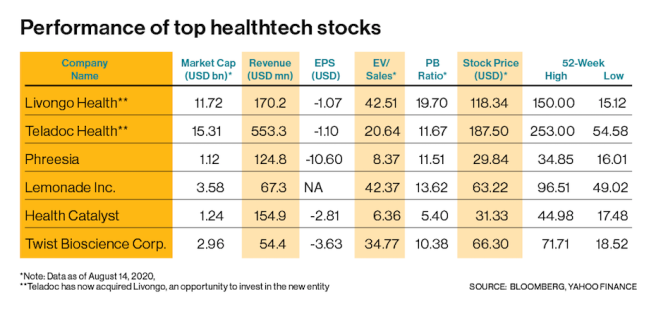

The equity market is no exception to this trend, and healthcare stocks that have integrated technology to develop innovative treatment outcomes have been witnessing incredible growth, outperforming peers within the healthcare space. For instance, Livongo Health, a provider of remote monitoring solutions driven through employer and payer distribution, has developed a technology that has cut annual healthcare costs by at least $1,908 for its clients.

The company registered an earnings surprise of 175 per cent in Q1 2020, with its stock up roughly 400 per cent since the beginning of 2020. A surge in telemedicine has driven a similar uptick in Teladoc, which has benefited from the growing adoption of virtual care. Its strong revenues (up 85 per cent year-on-year) reported in Q2 2020 was far higher than analyst estimates, driving its stock northwards (up 164 per cent year-to-date), despite reporting losses.

Teladoc has now agreed to acquire Livongo for $18.5bn, creating the largest holistic virtual health entity worth $38bn.

Phreesia is another such company, which shifted its focus to support the transition to virtual care amid the pandemic and launched a Covid-19 screening module that triages patients’ risk factors to avoid infection risk. While near-term prospects remain uncertain, strong fundamentals sustain the appeal of this stock. Similarly, Health Catalyst is another strong contender in the healthtech market. The company’s revenues are estimated to grow from $24bn in 2019 to roughly $77.6bn in 2020, buoyed by robust internal factors.

Lemonade, which has integrated new-age technology to appeal to the modern generation and recently ventured into health insurance offerings, stands apart from competitors due to its high-tech app ensuring speed and efficiency in its segment, with low-price subscriptions attracting higher consumer adoption and retention. Having listed in July 2020, Lemonade’s stock rose 139 per cent on its first trading day, marking the best IPO debut of the year (so far) and demonstrating the company’s strong investor appeal. Its stock price has risen by around 51 per cent since the initial public listing.

Lastly, Twist Bioscience is also likely to play an important role in the global Covid-19 response. The company reported revenues of $21.2m in Q2 2020, which was more than 50 per cent higher than the estimates. This has led to a rise of roughly 216.4 per cent in its stock price since the beginning of 2020.

An important point to note – it is prudent for investors to maintain appropriate cash positions at all times to capitalise on any downside in recommended stocks with a medium to long-term time horizon.

As global economies grapple with the pandemic, rapid technological innovation is hoped to bring the world one step closer to overcoming Covid-19. Thus, it has offered bitter-sweet opportunities for technology developers as creativity inspired by the crisis is likely to drive further innovation in the healthtech/medtech space.

The infrastructure and resources are already in place through technological deployment for many companies, but what the world now needs is a cohesive implementation of tech strategies, both by the private and the public stakeholders, as the best way forward to tackle the health crisis.

Comments